Wealth Consulting

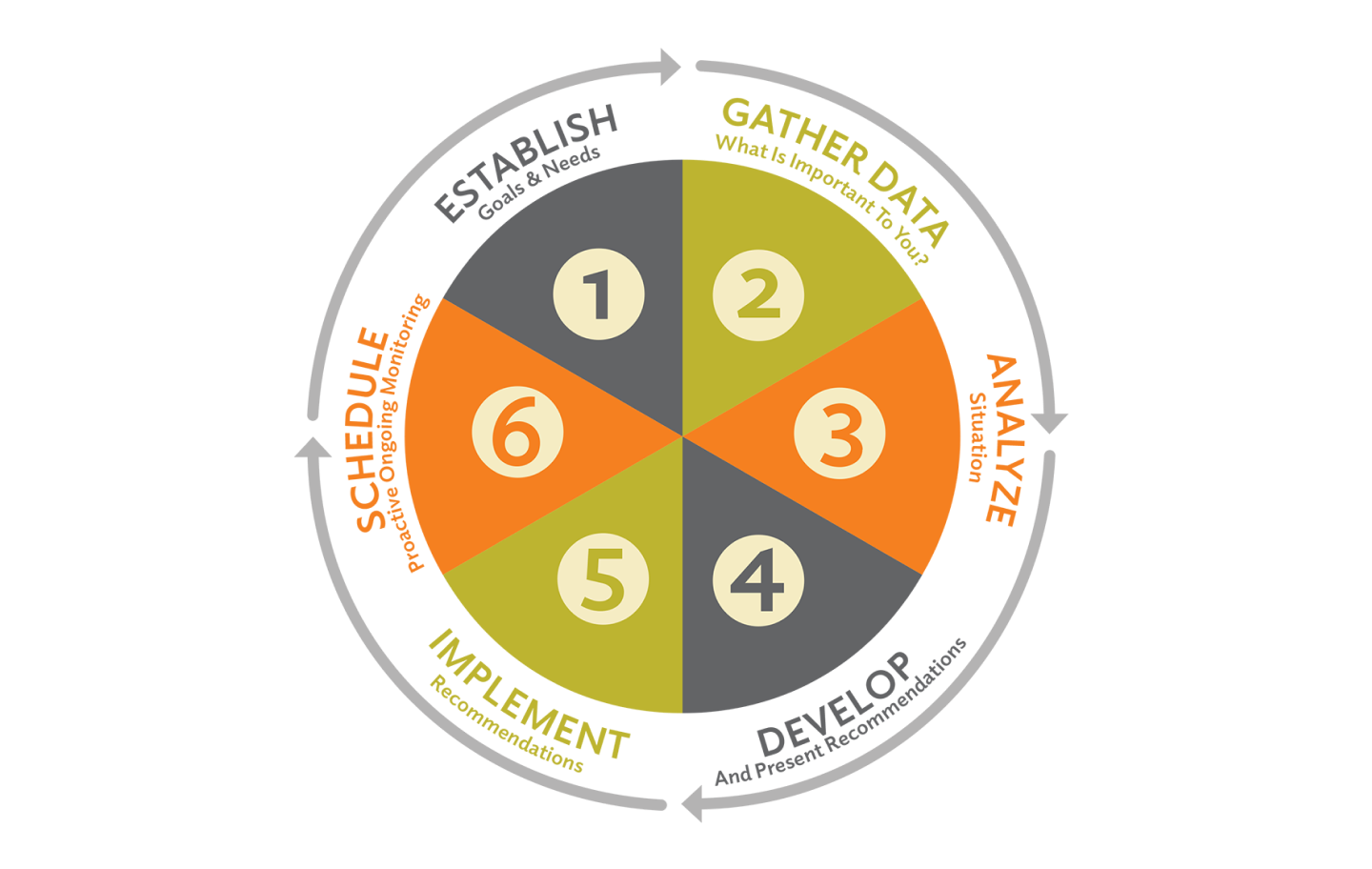

This is the core of what we do. It’s a financial physical. Getting a clear roadmap is paramount to your success regardless of where you’re financially or how much you have in assets. Wealth consulting consists of three meetings filled with education and guidance from our qualified team. Below is a list of deliverables we provide.

- Extensive review of your current insurance coverage and premiums (life, disability, long-term care, auto, home, and umbrella), ensuring they meet your needs.

- Inspect your estate plan, making sure it is current and complete, and still reflects your intentions.

- Analyze how your current investments contribute to your tax situation today and tomorrow.

- Determine if your current investments match your goals and risk tolerance, offering suggestions on areas of potential improvement, including social security and pension review for those it is applicable.

A one-time $2,500 fee.

Ongoing Asset Allocation & Investment Management

- Evaluate your risk tolerance

- Research optimal investment options and provide recommendations

- Implement a process for your investments

- Monitor investments and report to you on results

Wealth Management

- Consult with other members of your wealth management team such as CPA, attorney, and insurance professional

- Tax planning

- Estate planning

- Insurance planning

- Beneficiary review

- Create a written financial plan

- Behavioral finance